What is an insured mortgage?

What is an insured mortgage? An insured mortgage is when there is less than 20% down payment

WELCOME TO THE

Interdum et malesuada fames ac ante ipsum primis in faucibus. Vivamus non erat in ipsum viverra tempus. Sed ac odio sit amet quam rhoncus euismod.

results for:

What is an insured mortgage? An insured mortgage is when there is less than 20% down payment

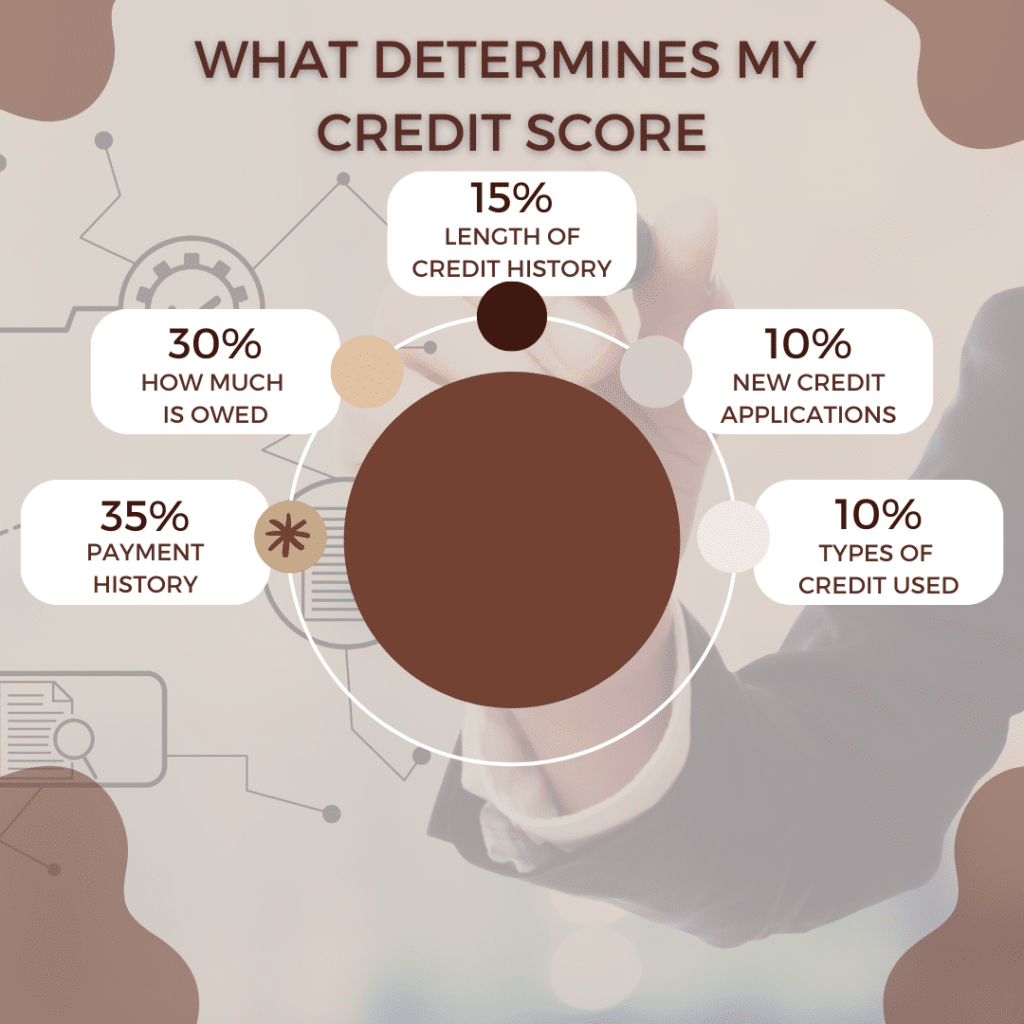

Introduction to Credit Scores As we navigate through life, we make financial decisions that can impact our financial future. From paying bills on time to paying off loans, it all plays a role in

There are many reasons to use a mortgage broker to find the right mortgage product. Shopping for a mortgage can be a stressful and confusing process. From researching lenders, loan types, and interest rates

If homeownership is something that is important to you, our 7 tips to get approved for a mortgage will help you get there. The home-buying process can be stressful but working with the right

GDS/TDS Ratios Explained When qualifying for a mortgage, lenders look at your debt service ratios. This tells lenders exactly how much you can afford to borrow for a new home purchase. It is a

Are you considering selling your home? Your first thought is to speak with a real estate agent but with all the financing changes it makes sense to speak with an independent mortgage broker. Talking

What does conditional mortgage approval really mean? Conditional mortgage approval is when a lender approves a mortgage based on the information they receive from a mortgage broker. When they issue a commitment it comes

The VIP Club

EVERY MONTH I AM GIVING AWAY SOMETHING FUN TO MY VIPS

Be the first to know about mortgage news, keep in touch, and win some cool giveaways.

MORTGAGE

(rate hold)

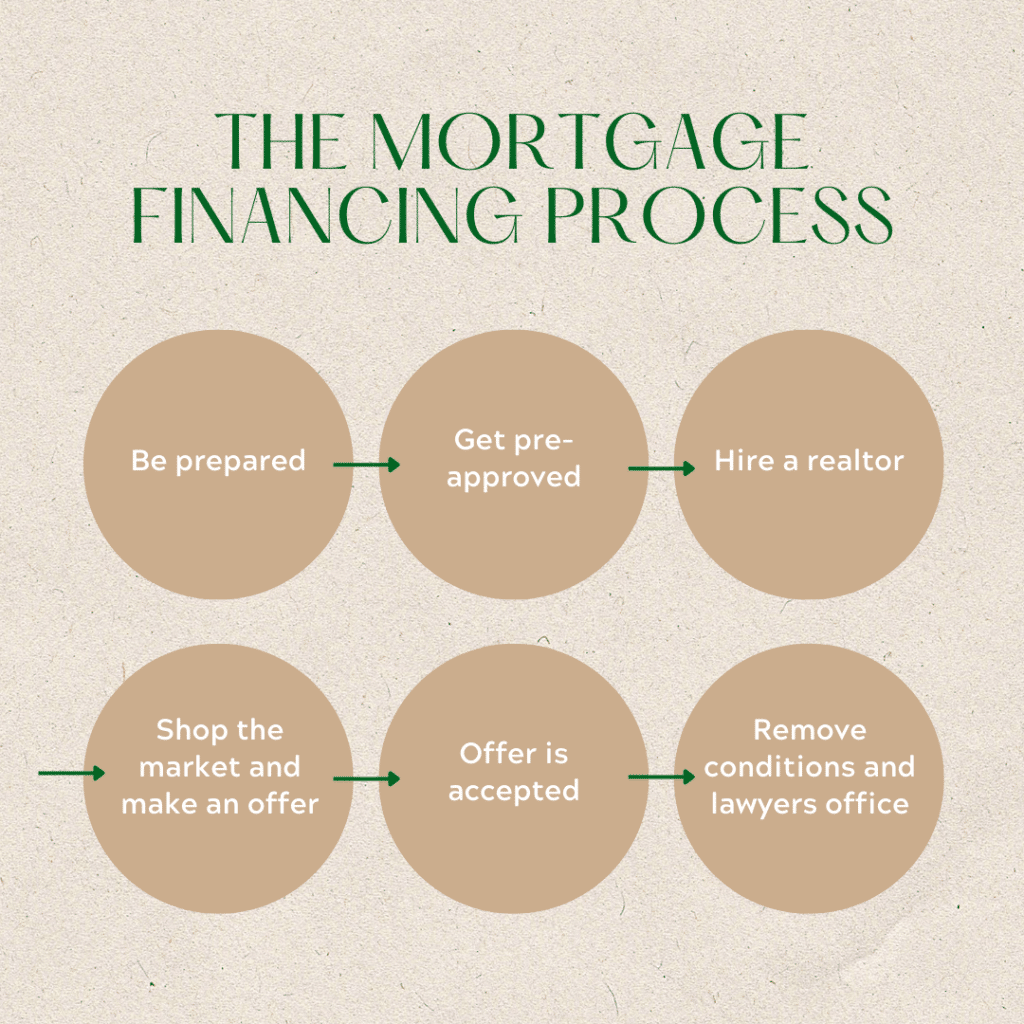

A mortgage pre-approval simply means that we’ve reviewed your credit score, income, assets and liabilities and determined the amount of money you should be able to borrow to purchase a home. Knowing the price range that you can comfortably afford will help you narrow your search and ensure you won’t be let down in finding out the home of your dreams is not within your reach.

BRINGING A BIT OF mortgage TO YOUR SCROLL

Join The VIP Club

Be the first to know about mortgage news, keep in touch, and win some cool giveaways.

© 2023 MORTGAGE TAILORS | ALL RIGHTS RESERVED