Debt is something most Canadians carry. Getting out of debt provides both financial and emotional relief so eliminating the debt allows a fresh start.

Let’s say you own a home for 7 years and carry 2 credit cards, one for 5,000, one for 11,000, and a line of credit for 22,000. The minimum payments on these 3 are $1140.00 per month so refinancing lowers the payments.

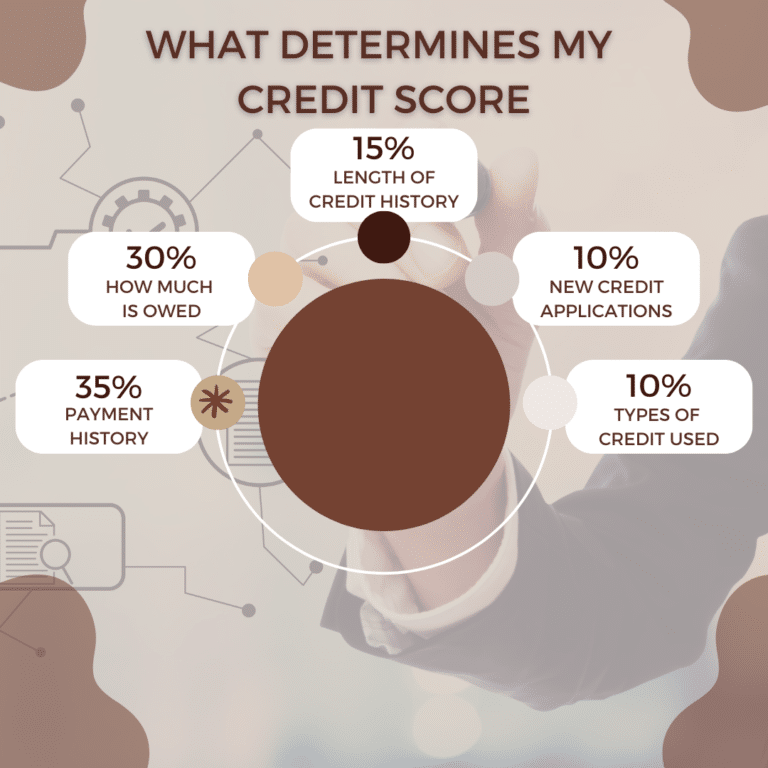

If you have equity built up in a home, which currently there is high demand for housing, property values have gone up. This is a great time to consolidate high-interest debt into a mortgage. Reducing 18% interest down to 4% provides substantial savings in both interests saved and cash flow.

Refinancing can occur anytime however breaking a current term does incur penalties. This is something we review so the cost savings are higher than the expenses.

Here are the pros and cons.

The pros of refinancing are accessing funds to renovate a home, purchasing an investment property, or consolidating debt to a lower interest rate, so you have one easy payment. Resetting your mortgage to lower the term and accelerate your mortgage pay down.

The cons of refinancing are the fees involved in restructuring the mortgage. There is an appraisal fee, lawyer fees, and penalty fees for breaking the previous mortgage term.

The bottom line? If the money you save is more than the cost of refinancing, or if you’re willing to pay the costs to negotiate for terms that you want — then it may be the right choice.

Save money by getting low rates from Mortgage Tailors. We check multiple lenders including your current lender to see where the best opportunity is to save the most.

If you NEED funds refinancing may be the best solution. Mortgage Tailors can unlock up to 80% of a property’s appraised value. From this new mortgage amount, the existing lender must be paid out including any fees they may charge as well as new legal fees. The remaining amount is what is available to pay off debt, renovate a home, put in a new hot tub, take a well-deserved holiday, or use the funds for investment purposes.

Before you get started, ask yourself.

Are you tired of making multiple payments each month?

Do you find you are only making minimum payments each month?

Are creditors charging a higher interest rate than current mortgage rates?

Do you wish you had money to purchase investments?

If the answer is “Yes” to any of the above, Mortgage Tailors has the best solution to reduce multiple payments, eliminate credit card debt and free up cash to top up your investments. We are just a phone call away. It’s super easy to get started.