Cash damming is a sophisticated financial strategy that transforms personal non-deductible debt into tax-deductible business debt, offering potential tax reductions for rental property owners. Employing cash damming for rental property can be a significant shift in accounting practices, enabling owners to leverage tax benefits efficiently. This methodology uniquely aligns with the financial intricacies of managing rental properties.

This article will dissect the operational mechanics of cash damming, its benefits and risks, and compare it with other financial strategies. Focusing on optimizing accounting practices for rental property owners, we aim to provide a comprehensive understanding of how cash damming could revolutionize financial management in the real estate sector.

Understanding Cash Damming

Cash damming is a financial strategy designed to convert personal, non-deductible debt into business or investment debt, allowing property owners to benefit from tax deductions on interest payments. This process involves several key steps and prerequisites:

- Eligibility and Implementation:

- Suitable for homeowners with a mortgage on their principal residence who also own or intend to own rental properties.

- A line of credit or loan facility, capable of directly linking borrowed funds to an income-earning purpose, is essential.

- Operational Mechanics:

- Utilize a line of credit to cover business expenses, including those related to rental properties.

- Personal expenses are paid directly from rental income, while borrowed funds finance rental property expenses.

- Eligible rental property expenses include mortgage interest, property taxes, and maintenance costs.

- Separate accounts for borrowed funds and other finances are recommended to maintain interest deductibility.

- Tax Implications and Benefits:

- The interest on borrowed funds becomes tax-deductible, potentially reducing overall taxes.

- The strategy has received technical approval from the Canada Revenue Agency, affirming its legitimacy.

- Cash damming can lead to increased tax refunds, improved cash flow efficiency, and reduced interest costs over time.

Cash damming is not universally applicable and requires careful planning and consultation with financial professionals to ensure compliance and optimize benefits.

Operational Mechanics of Cash Damming

The operational mechanics of cash damming for rental properties involve a strategic approach to managing finances and leveraging tax deductions. Here’s a breakdown:

- Initial Setup and Eligibility:

- Eligibility Criteria: Ownership of at least one rental property and a non-deductible mortgage debt of $50,000 or more on the principal residence.

- Required Facilities: A re-advanceable home equity line of credit (HELOC) or similar loan facility that allows borrowing for business expenses and purchasing investment assets.

- Process Flow:

- Income and Expense Management: Rental income is utilized to pay down the mortgage on the principal residence. Concurrently, borrowed funds from a HELOC are used to cover monthly rental property expenses, thereby transforming personal debt into business or investment debt.

- Interest Deductibility and Record Keeping: To maintain the tax deductibility of interest, it’s crucial to use separate accounts for borrowed money and personal finances. Direct linking of borrowed funds to income-earning purposes and meticulous tracking of expenses and borrowed funds are essential.

- Financial Outcomes:

- Tax Benefits: The conversion of non-deductible personal debt into tax-deductible business debt can lead to significant tax savings.

- Mortgage Management and Tax Refunds: Increased tax refunds can be strategically used to accelerate the repayment of the principal residence mortgage, reducing long-term interest costs.

By adhering to these operational mechanics, rental property owners can optimize their accounting practices, ensuring compliance while maximizing financial benefits through cash damming.

Benefits and Risks of Cash Damming

Benefits of Cash Damming

- Tax Savings and Efficiency: The primary advantage of cash damming is the potential for significant tax savings by reorganizing cash flows to make interest payments on loans for rental properties or business expenses tax-deductible. This strategic financial management can lead to faster debt repayment and long-term wealth accumulation.

- Rapid Mortgage Paydown: Increased tax refunds can be utilized to accelerate the repayment of non-deductible mortgages on primary residences. This conversion of personal debt into tax-deductible business debt not only reduces long-term interest costs but also facilitates faster accumulation of equity.

- Flexibility and Debt Management: Cash damming offers flexibility in managing debts and can be particularly beneficial for unincorporated business owners or rental property owners. The strategy enables the deduction of interest paid on loans used for business expenses, potentially lowering taxable income.

Risks of Cash Damming

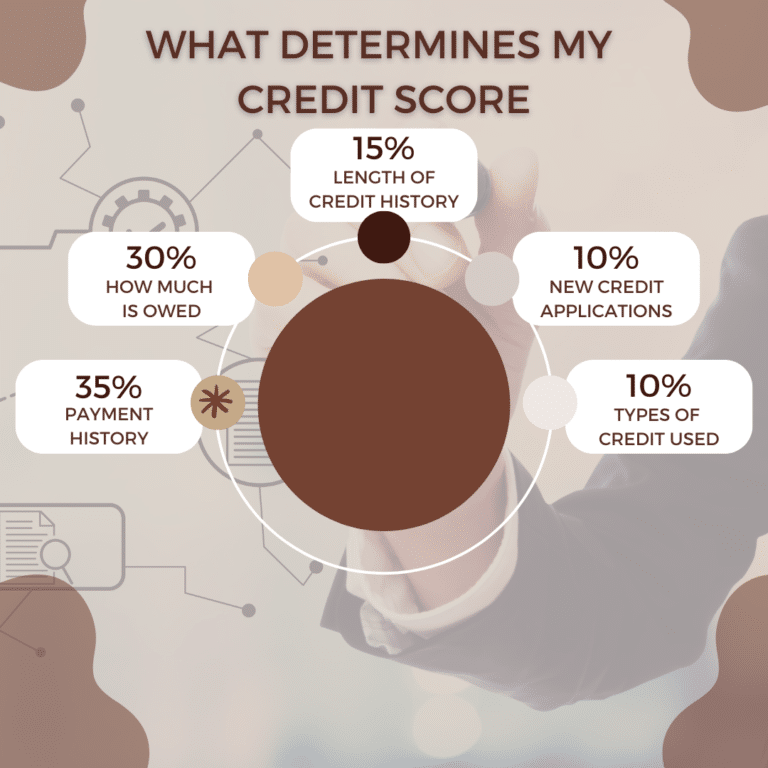

- Credit Requirements and Discipline: Implementing cash damming successfully necessitates a high credit score, as the strategy is predominantly available to AAA borrowers. Moreover, maintaining long-term discipline for the repayment of the investment loan is crucial to avoid financial strain.

- Economic Risks and Debt Accumulation: Borrowing to invest introduces an additional layer of risk, especially in volatile economic conditions. Sufficient surplus cash flow is essential to cover monthly payments and withstand potential downturns. Without careful management, cash damming can lead to an accumulation of debt, adding to the mortgage and potentially complicating financial health over time.

- Interest Rate Considerations: The profitability of the cash damming strategy hinges on the relationship between personal debt interest rates and the interest rate on the line of credit. It is vital that the interest rate on the borrowed funds is lower than the mortgage rate to ensure that the income tax savings outweigh the incremental borrowing cost.

Implementing cash damming requires meticulous planning and consultation with qualified professionals to navigate its complexities and ensure compliance with tax laws while maximizing financial benefits.

Comparing Cash Damming with Other Financial Strategies

When exploring financial strategies for rental property owners, it’s essential to compare the nuances of cash damming with other approaches, such as the Smith Manoeuvre. Here’s a concise comparison:

- Flexibility in the Use of Funds:

- Cash Damming: Offers broad flexibility, allowing rental income to be used for various purposes, including paying down non-deductible primary residence mortgages and funding monthly rental expenses .

- Smith Manoeuvre: Requires that cash be specifically invested in taxable accounts, limiting its use to investment purposes only.

- Investment Risk:

- Cash Damming: Acts as a pure tax strategy without direct investment risk, focusing solely on optimizing tax deductions related to rental property expenses. It does not necessitate investing or using personal cash flow for investment purposes [5] https://edrempel.com/what-is-the-cash-dam/.

- Smith Manoeuvre: Involves investment risk by mandating the borrowed money be invested in taxable accounts. The success of this strategy is tied to the performance of the investments made with the borrowed funds [6] https://smithmanoeuvre.com/cash-flow-dam-strategy/.

Understanding these distinctions helps rental property owners make informed decisions tailored to their financial goals and risk tolerance. Cash damming’s appeal lies in its flexibility and lower risk profile, catering specifically to those looking to maximize tax efficiency without the added investment risk.

Conclusion

Through the exploration of cash damming, this article has illuminated a sophisticated financial strategy that offers rental property owners the opportunity to transform personal debt into tax-deductible business debt, potentially yielding significant tax savings. By delineating the operational mechanics, benefits, and inherent risks, alongside a comparison with other financial strategies like the Smith Manoeuvre, it equips property owners with the knowledge to leverage their assets more efficiently. The key takeaway is the potential to enhance cash flow and accumulate wealth over time through strategic tax planning and disciplined financial management.

However, it’s imperative for rental property owners considering this approach to engage with financial professionals. This ensures compliance with tax laws and maximizes the benefits of cash damming while navigating its complexities and risks. The broader implications of leveraging such a strategy underscore its significance in potentially reshaping financial management within the real estate sector, encouraging a deeper understanding and more informed decision-making among property owners. As the landscape of real estate investment continues to evolve, cash damming is a vital tool for those seeking to optimize their financial health and investment returns.

FAQs

Understanding Cash Damming and Related Financial Strategies for Rental Properties

1. What does the cash damming method entail?The cash damming method is a financial strategy designed to lower your income taxes. It does this by transforming personal debt, which does not allow for deductible interest, into business-related debt. This new form of debt is used to cover business expenses and its interest is fully deductible.

2. Can you explain the Smith Maneuver in the context of Canadian real estate?In Canada, the Smith Maneuver is recognized as a legitimate tax strategy that transforms the interest paid on a residential mortgage into tax-deductible interest for an investment loan. This method serves as a financial planning tool, aiming to provide tax benefits for homeowners.

3. Is it possible to make a 5% down payment on an investment property in Canada?Yes, when purchasing an investment property in Canada, you can make a down payment as low as 5%. Additionally, up to 50% of the income generated from the rental portion of the property may be considered part of your regular income. This can potentially qualify you for a more expensive purchase than would otherwise be possible.

4. Can rental income be used to secure a mortgage in Canada?Indeed, most lenders in Canada will allow you to use rental income as part of your qualifications for a mortgage, provided you adhere to the guidelines set by the Canadian Mortgage and Housing Corporation (CMHC). Key requirements include having a strong credit history and residing on the property.