As summer rolls in, it’s the prime time to dive into real estate investing. But, diving in is more than just a leap of faith; it’s about smart planning and sidestepping the usual traps that can snag newcomers.

Dive into knowledge

With the market still finding its rhythm post-pandemic, knowing your local real estate scene inside out is key. Get to grips with everything from zoning laws to what renters are looking for and where prices are headed. Armed with this info, you’re not just ready for the opportunities but also sturdy enough to handle any market wobbles.

Leverage what you’ve got

Waiting for a big pile of cash to start investing? You could be waiting a while. If you already own a home, there’s probably equity there you could use to get started. And remember, borrowing to invest can be a smart move—it’s about using resources wisely to get ahead.

Timing isn’t everything

Waiting for the perfect market moment can be tricky. The market is always up and down, and waiting on the sidelines could mean missing out. It’s more about being in the game for the long haul, with a solid strategy that sees you through the ups and downs.

Strategy is key

It’s crucial to have clear goals, know your financing options, and have a plan for what you’ll do down the line. This kind of planning doesn’t just help at the start; it keeps you growing and adapting as you go.

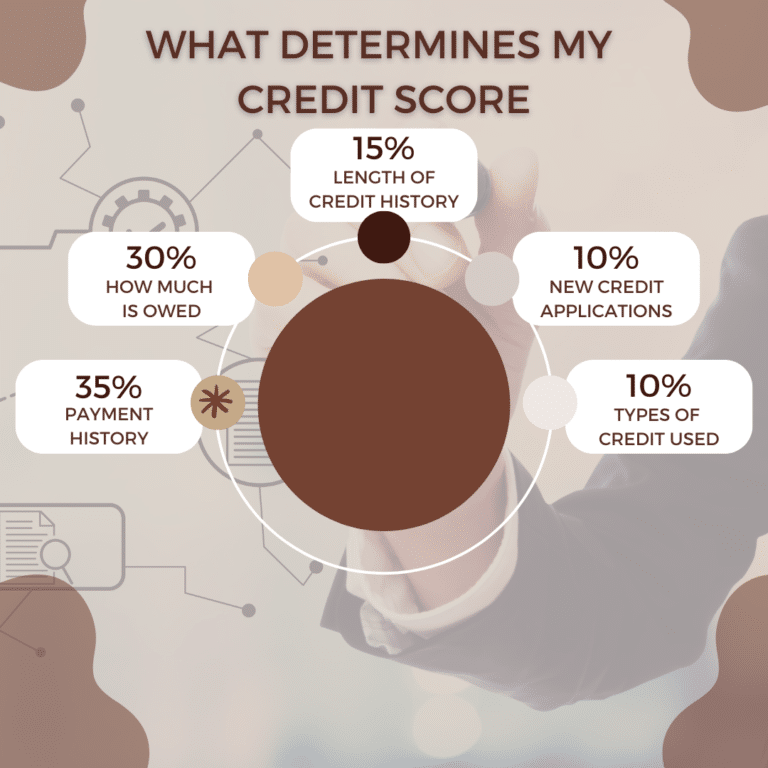

Don’t overlook taxes

If you’re not looking at how to make your investments tax-efficient, you’re likely leaving money on the table. Strategies like rental cash damming can turn your tax situation from a headache into an advantage, boosting your returns and helping you navigate even when interest rates are high.

Making it work

Whether it’s your first or fifth investment, rental cash damming can be a game-changer. It’s about making your investments work smarter, turning what’s usually a cost into a benefit. This approach isn’t just about saving money; it’s about setting up a cycle of growth that keeps on giving, no matter how the market swings.

As we enter the season of opportunities this summer brings, remember that investing in real estate involves careful planning and smart strategies. Whether you’re eyeing your first property or looking to add to your collection, bringing in smart strategies like cash damming can make all the difference.

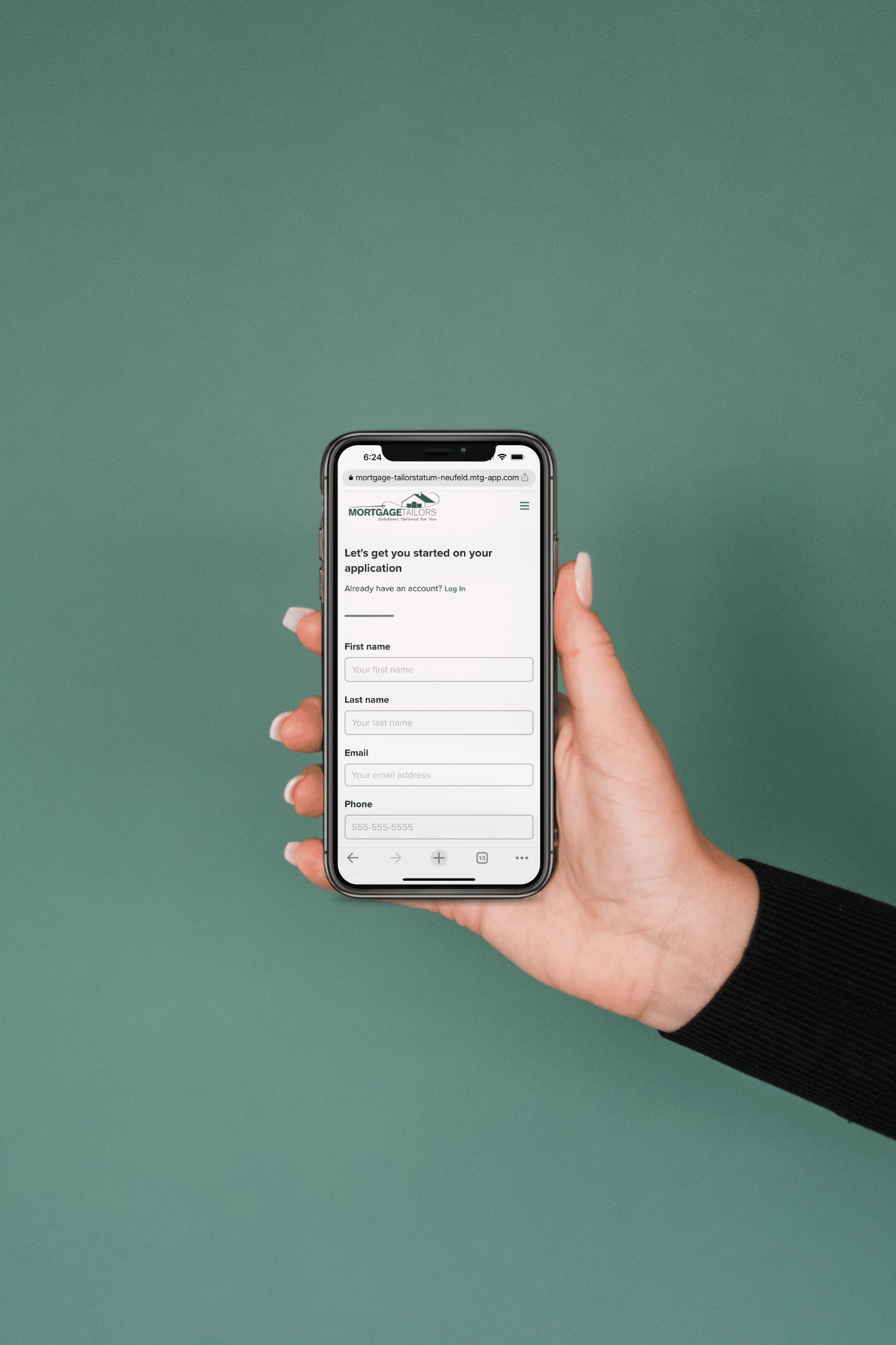

Thinking about making a move? Let’s chat about how to get your investment journey off to a strong start with the right plans in place to make it a success.