RESP vs Rental Property, Which is the Better Choice?

When it comes to investing, there are many options available. Two of the most popular options are Registered Education Savings Plans (RESPs) and rental property investing. Both of these investments provide the potential for growth and potential for income, but each comes with its own set of advantages and disadvantages. In this article, we’ll compare the differences between these two inve stments and discuss which one is the better choice.

Overview of RESP and Rental Property Investing

RESPs are special savings accounts designed to help families save for a child’s future education costs. The money that is saved in an RESP is invested in stocks, bonds, mutual funds, and other investment vehicles. The returns on these investments are not taxed, and the account holder is eligible for government grants and other incentives.

Rental property investing, on the other hand, involves buying and managing residential and/or commercial properties in order to generate income. This type of investment is often seen as a long-term investment, as the investor will typically hold the property for a few years before selling it. The returns on rental properties can come in the form of rental income, appreciation, and tax benefits.

Advantages and Disadvantages of RESP

One of the main advantages of investing in an RESP is that it is a tax-advantaged investment. The returns on the investments are not taxed, and the account holder is eligible for government grants and other incentives. This makes it a great option for people who want to save for their children’s education without having to pay taxes on the returns. Another advantage of investing in an RESP is that it is a relatively low-risk investment. The investments in the account are diversified, so there is less risk of losing money. Additionally, the returns on the investments are often quite high.

However, there are some drawbacks to investing in an RESP. For one, the funds in the account are locked in until the beneficiary reaches the age of 18. This means that the account holder cannot access the funds until then. Additionally, government grants and incentives are only available if the funds are used for educational purposes.

Advantages and Disadvantages of Rental Property Investing

Rental property investing has a number of advantages. For one, it can provide a steady stream of income. The investor can charge rent on the property and collect it on a regular basis. Additionally, the investor can also benefit from appreciation in the value of the property over time. Another advantage of rental property investing is that it can provide tax benefits. The investor can deduct certain expenses and depreciation from their taxes, which can help to reduce their overall tax liability. Additionally, rental properties can also provide a form of passive income, as the investor does not have to actively manage the property in order to generate income. However, there are some drawbacks to rental property investing. For one, it can be a risky investment, as the value of

the property can fluctuate and the investor can be stuck with a property that is hard to sell.

Comparing the Costs of RESP and Rental Property Investing

When it comes to the cost of investing, both RESP and rental property investing have their own set of costs. For RESP investments, there are typically two main costs: the contribution cost, which is the amount of money that is invested in the account, and the management cost, which is the fee that is charged for managing the account. For rental property investment, the main cost is the cost of purchasing the property. This cost can vary depending on the location and size of the property. Additionally, there are also other costs associated with rental property investments, such as taxes, insurance, maintenance, and repairs.

Comparing the Return on Investment of RESP and Rental Property Investing

When it comes to the return on investment, both RESP and rental property investments can provide a good return. For RESP investments, the return on investment can vary depending on the investments in the account. Generally, the return on investment is higher with higher-risk investments, but there is also the risk of losing money. For rental property investments, the return on investment can vary depending on the rental income and appreciation of the property. Typically, rental properties can provide a higher return on investment than RESP investments, but there is also the risk of losing money if the property does not appreciate in value or the investor cannot generate enough rental income.

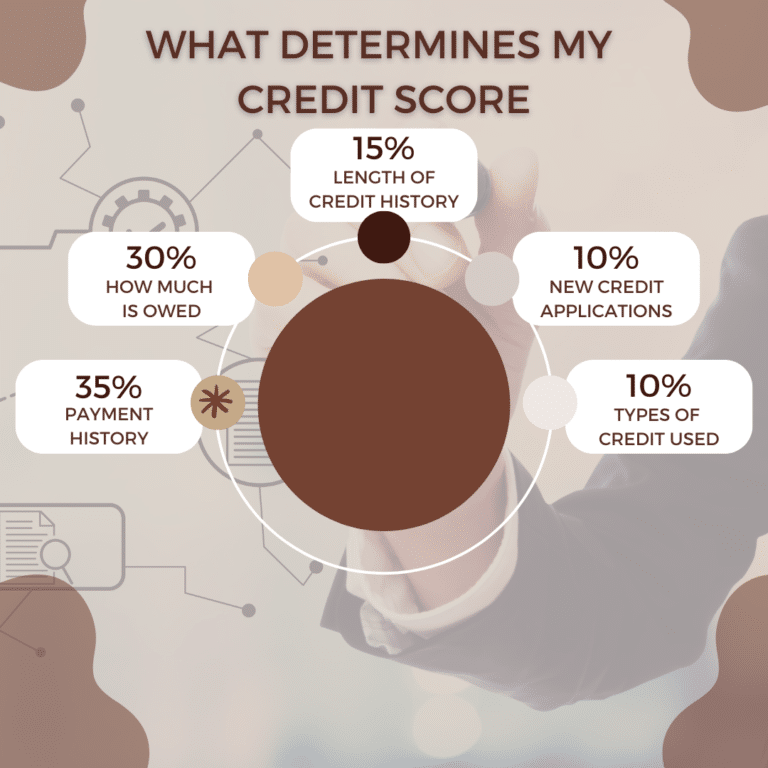

Tax Implications of RESP and Rental Property Investing

When it comes to taxes, both RESP and rental property investments have their own set of tax implications. For RESP investments, the returns are not taxed, and the account holder is eligible for government grants and other incentives. For rental property investments, the investor can deduct certain expenses and depreciation from their taxes. Additionally, rental properties can also provide a form of passive income, as the investor does not have to actively manage the property in order to generate income.

Which is the Better Choice – RESP or Rental Property Investing?

When it comes to choosing between RESP and rental property investing, it ultimately comes down to your individual goals and risk tolerance. RESP investments are typically less risky and can provide a good return, while rental property investments can provide a higher return but also come with more risk.

If you are looking for a long-term investment with the potential for steady income, then rental property investing may be the better choice. However, if you are looking for a low-risk investment that can provide a good return without the need for active management, then an RESP may be the better option. I understand that investing in RRSP/Mutual Funds, TFSA, etc., makes sense for some people. However, you are missing out on a massive opportunity since you aren’t leveraging someone else’s money and only earning interest on your hardearned cash. Real estate allows you to put only 20% of the total property value and let someone else pay off the mortgage for you.

Here is a breakdown – the numbers don’t lie.

To show the difference, we need to compare apples to apples. In this example, we will assume you are putting $400/mth away into an RESP, RRSP, TFSA, Mutual Funds, or Savings Account.

RRSP/RESP/Mutual Funds

-$400 investment each month

-12 months/year

-15 years

-4% Annual return on investment

$98,436 = Total Savings After 15 years

Real Estate Investment

-$400/mth would be the approx. cost to borrow a

-$100,000 Down Payment

-$400,000 Mortgage

= $500,000 Investment Property

15 Years Of Ownership

4% Annual Appreciation

= $900,471 after 15 years

Mortgage remaining after 15 years = $246,189

Equity created in property $654,282 – $100,000 Initial down payment

$554,282 = Total Equity After 15 years

Conclusion

When it comes to choosing between RESP and rental property investing, it is important to consider your individual goals and risk tolerance. RESP investments are typically less risky and can provide a good return, while rental property investments can provide a higher return but also come with more risk. Ultimately, the choice between the two investments will depend on your individual needs and preferences. No matter which investment option you choose, it is important to do your research and make sure that you understand the risks and rewards of each. Investing in either option can provide the potential for growth and potential for income, but it is important to make sure that you are making an informed decision.

Real estate investing can be a great way to grow your wealth and provide a steady stream of income. Whether you choose to invest in an RESP or in rental properties, you should be sure to do your due diligence and understand the risks and rewards of each investment before making a decision.