Is now a perfect time to refinance your home? There really is no perfect time but really depends entirely on why you want to refinance your home and whether or not you are financially prepared to do so.

You might refinance your home to get a lower rate, access equity in your home or consolidate your debts. Either way, breaking your mortgage does incur costs such as a mortgage penalty, appraisal costs to confirm the value of your property and of course new legal costs to register the new mortgage.

Refinancing your mortgage is a serious and long-term commitment. It should not be entered into lightly.

For this reason, Mortgage Tailors wants to ensure that you understand what it takes to refinance your Edmonton home. This way, you can make an educated decision that benefits both you and your finances.

Ready to get started? Let’s review some reasons to refinance your mortgage:

1. Getting a lower interest rate

2. Accessing equity (cash) in your home

3. Refinancing to consolidate debt

4. Funding a child’s education

5. Buying an investment property

6. Accessing funds for renovations

Borrowing against your home is a temporary solution, but also an opportunity to build good credit history. If done properly, it can improve your financial situation in the long run.

Let’s start with your home, does it have enough equity to achieve your financial goals. Lenders allow us to refinance up to 80% of the properties appraised value.

There are many options to access equity, you can choose between a home equity line of credit (HELOC) and a blended mortgage. HELOC’s offer a better interest rate than an unsecured line of credit.

There is also the option to blend and extend your current mortgage. This is taking your current mortgage and interest rate and blend them into a new blended interest rate. This option can avoid paying a prepayment penalty that comes with a typical refinance. Not every lender offers this option, so it really depends on who your current mortgage is with.

Is Refinancing My Home My Best Option?

While the lower interest rates that come with mortgage refinancing are beneficial, they don’t apply to all applicants in all situations.

Let’s start with finding the current market value of your home and explore which financing option is the best for your financial goals.

Speak to a mortgage professional who can assist you with an evaluation of the market and help you decide if refinancing is your best option.

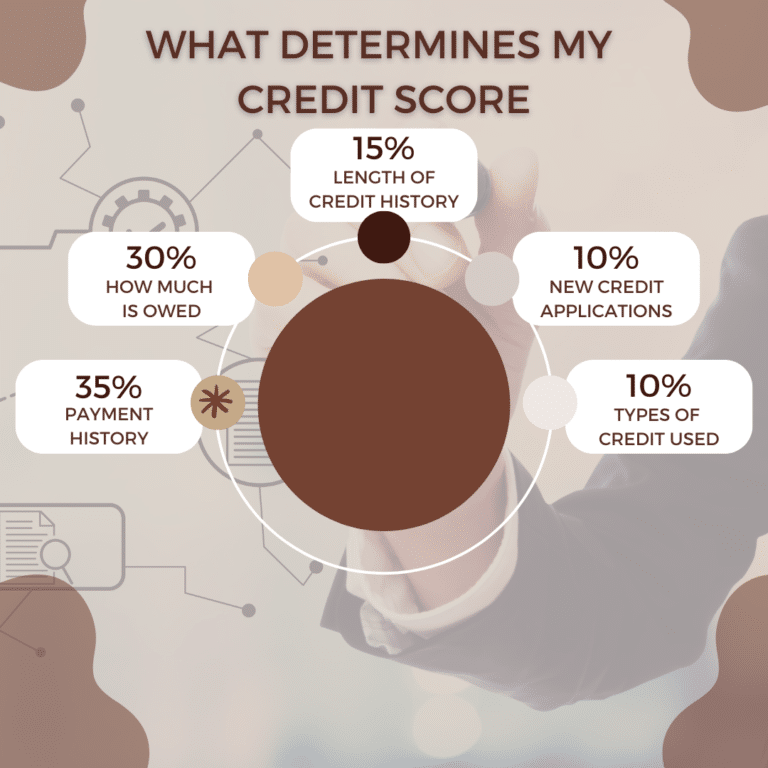

Why is My Credit Score Important?

Getting approved for a loan application all comes down to your credit score.

Lenders look at how you have previously paid for your debts, have you made payments on time and how you handle debt.

If your credit score is lower, traditional banks may decline you however we have many options to help with financing.

If your credit score is low, take the time to fix it before applying for mortgage refinancing. You can even speak to mortgage specialists about ways to improve your credit.

Overall, mortgage lending is the cheapest form of borrowing. Our expert mortgage specialists can help you unlock up to 80% of your home’s value and convert that into usable funds to reach your financial goals.

We understand everyone is different. We are committed to helping you every step of the way. Mortgage Tailors is based on the foundation of integrity and knowledge and we have your best interest in mind.