Introduction to Credit Scores

As we navigate through life, we make financial decisions that can impact our financial future. From paying bills on time to paying off loans, it all plays a role in our credit score. But what exactly is a credit score, and why is it important? In this article, I will be discussing the factors that affect your credit score, what a good credit score is, how to check your credit score, tips to improve your credit score, the benefits of having a good credit score, how to maintain a good credit score, and common credit score myths debunked.

What is a Credit Score and Why is it Important?

A credit score is a numerical representation of an individual’s creditworthiness. It gives lenders an idea of how likely you are to pay back your debts. The most commonly used credit score in the United States is the FICO score, which ranges from 300 to 850. The higher the score, the better the creditworthiness.

A credit score is important because it can impact your ability to get approved for loans, credit cards, and even rental applications. A higher credit score can also result in lower interest rates, which can save you money over time.

Factors That Affect Your Credit Score

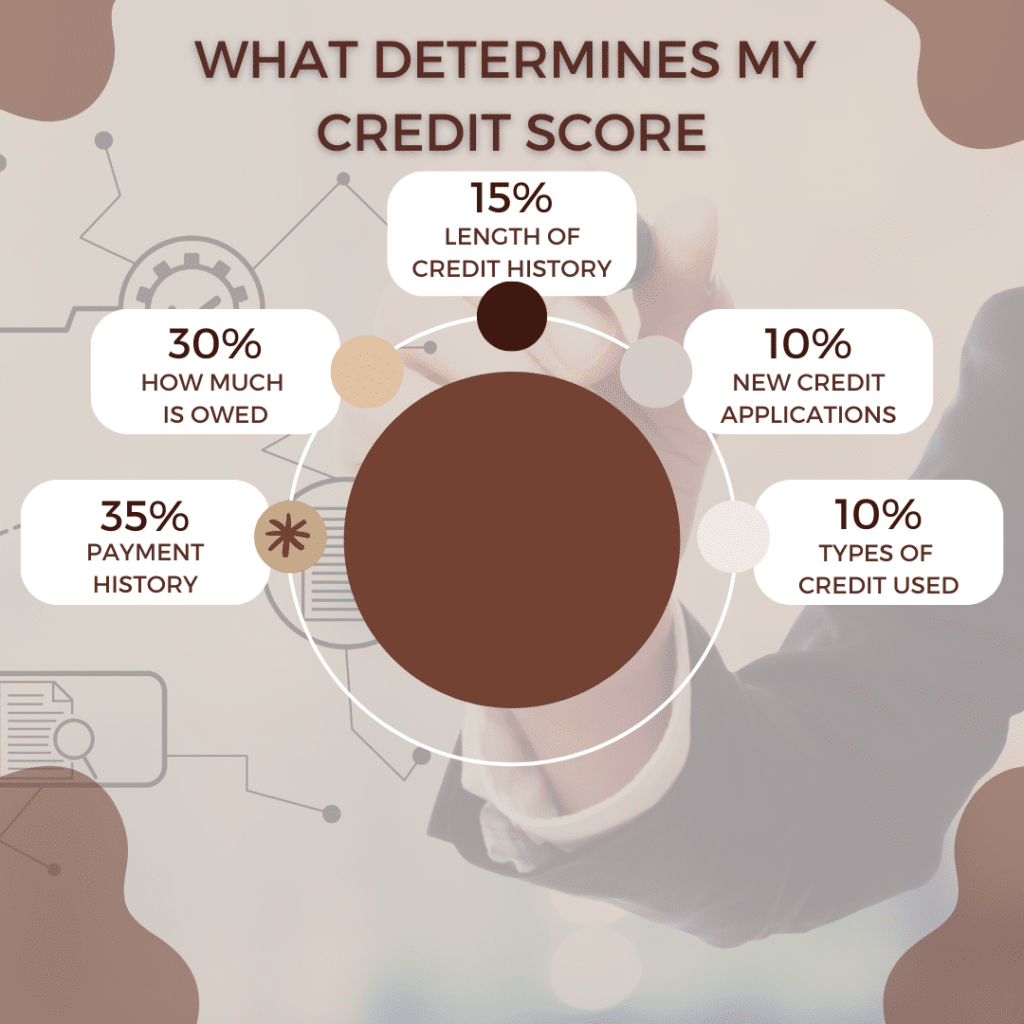

Several factors can affect your credit score, including payment history, credit utilization, length of credit history, types of credit accounts, and new credit inquiries.

Payment history is the most significant factor that impacts your credit score. Late payments, collections, and

bankruptcies can all negatively impact your credit score. Making on-time payments can significantly improve your

credit score.

Credit utilization is the amount of credit you’re using compared to the amount of credit available to you. Lenders like to see a credit utilization rate of 30% or lower.

The length of your credit history is another essential factor. The longer you’ve had credit, the better it is for your credit score. It shows lenders that you have a history of managing credit responsibly.

The types of credit accounts you have can also impact your credit score. Lenders like to see a mix of credit accounts,

such as credit cards, car loans, and mortgages.

New credit inquiries can negatively impact your credit score. When you apply for new credit, it results in a hard inquiry on your credit report, which can lower your score.

What is a Good Credit Score and Why Does it Matter?

A good credit score is generally considered to be 670 or higher. A score of 740 or higher is considered excellent. A good credit score matters because it can impact your ability to get approved for loans, credit cards, and rental applications. A higher credit score can also result in lower interest rates, which can save you money over time.

A good credit score can also provide peace of mind. It shows lenders that you are responsible with credit and can

manage your finances effectively.

How to Check Your Credit Score

You can check your credit score for free at Equifax.ca. This site allows you to access your credit report from each of the three credit bureaus (Equifax, Experian, and TransUnion) once a year. You can also sign up for a credit monitoring service that will provide you with regular updates on your credit score.

Tips to Improve Your Credit Score

If you have a low credit score, there are steps you can take to improve it. The first step is to make on-time payments. Late payments can significantly impact your credit score.

Another tip is to pay down your credit card balances. High credit card balances can negatively impact your credit

utilization rate, which can lower your credit score.

It’s also essential to check your credit report for errors. If you find errors, you can dispute them with the credit bureaus.

Finally, avoid applying for new credit unless necessary. New credit inquiries can negatively impact your credit score.

The Benefits of Having a Good Credit Score

Having a good credit score can provide several benefits, including lower interest rates on loans and credit cards, higher credit limits, and approval for rental applications. A good credit score can also provide peace of mind, knowing that you are responsible with credit and can manage your finances effectively.

How to Maintain a Good Credit Score

To maintain a good credit score, it’s essential to continue making on-time payments, keeping your credit utilization rate

low, and avoiding new credit inquiries. It’s also important to monitor your credit report regularly and dispute any

errors.

Common Credit Score Myths Debunked

There are several common credit score myths that can impact your understanding of credit scores. One myth is that

checking your credit score will lower it. This is not true. Checking your credit score is considered a soft inquiry and will not impact your score.

Another myth is that closing credit card accounts will improve your credit score. This is also not true. Closing credit card accounts can negatively impact your credit utilization rate, which can lower your credit score.

Conclusion – The Magic Number to Aim for in Your Credit Score

In conclusion, a good credit score is generally considered to be 680 or higher. A score of 740 or higher is considered excellent. Maintaining a good credit score is essential because it can impact your ability to get approved for loans, credit cards, and rental applications. It can also result in lower interest rates, which can save you money over time. By making on-time payments, keeping your credit utilization rate low, and avoiding new credit inquiries, you can maintain a good credit score and achieve financial success.