Are you interested to make your mortgage tax deductible?

Debt is pretty much a given; even wealthy people have debt. The difference is that they turn their loans into good debt by making the interest tax-deductible with the help of accountants and lawyers.

The Smith Maneuver is a legal tax strategy that effectively makes interest on a residential mortgage tax-deductible in Canada. Mortgage interest on your residential mortgage is not tax-deductible and must be paid with after-tax dollars. This is because in Canada when one borrows to invest with the reasonable expectation of generating income, the taxpayer may deduct the related interest from income.

By using the Smith Maneuver, homeowners can make their interest tax-deductible. They receive increased annual tax refunds and reduce the number of years on their mortgage, and increase their net worth.

It is important to note that this does not extend to loans taken for investments made in registered plans, such as (RRSPs), and other tax-free accounts, because they are already tax-advantaged.

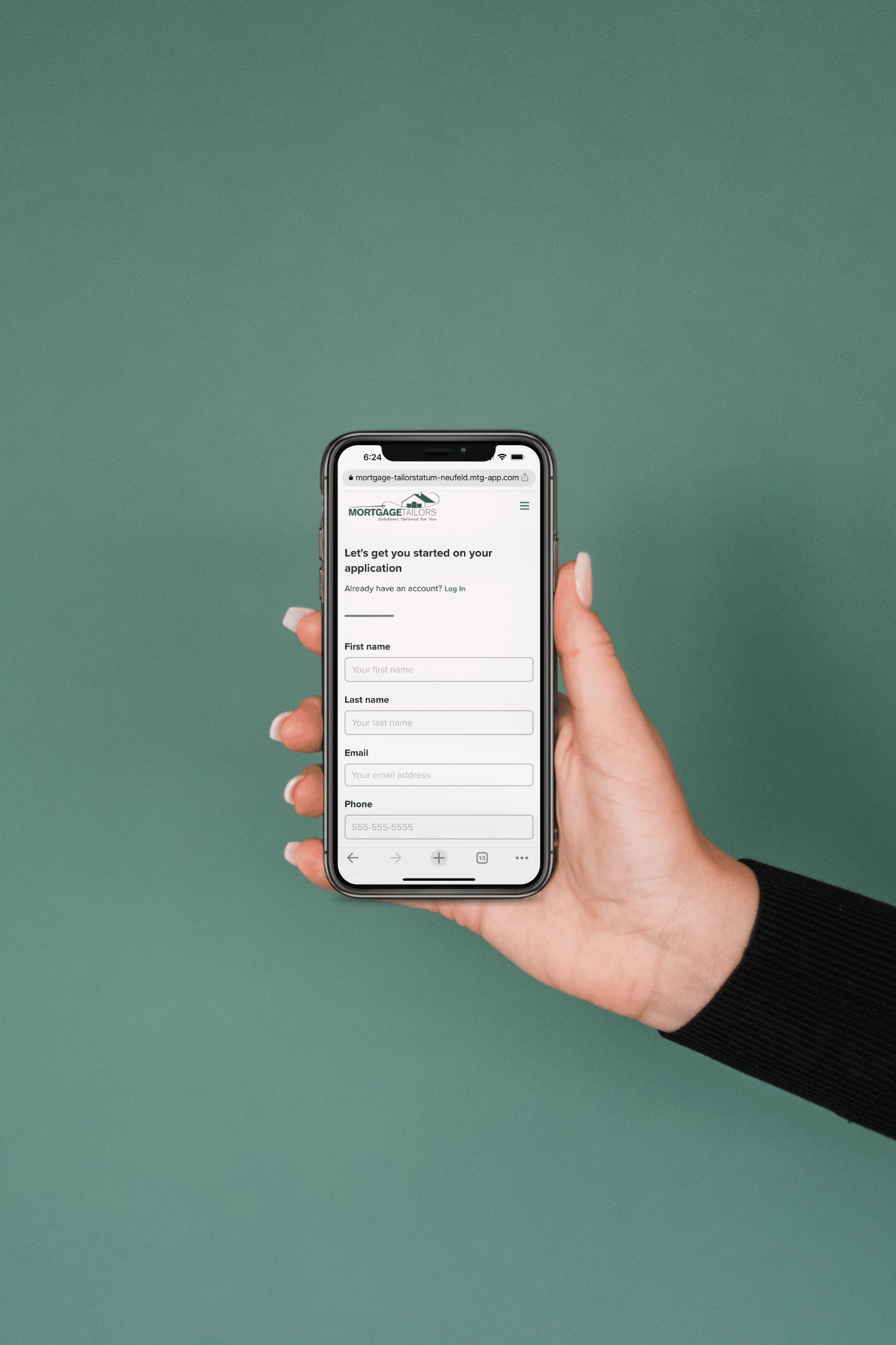

To make this work, a borrower needs to obtain a re-advanceable mortgage, which is slightly different than a conventional mortgage.

It consists of a mortgage and a line of credit – called a HELOC, or home equity line of credit bundled together.

Primary mistakes investors make when it comes to tax and interest costs.

As investors, we have been taught to keep our personal and rental expenses separate to maintain a clear audit trail for tax purposes. Many Canadians are missing out on a big opportunity to save taxes, reduce interest costs and improve the return on investment from their portfolio.

This is accomplished from a financial technique known as rental cash damming, where investors use cash flow from their rental portfolio to convert their primary residence mortgage into a tax-deductible investment loan.

Real estate investors understand that when you borrow money to purchase a rental property, the mortgage interest is tax-deductible. The same goes for any expenses related to carrying the property, such as maintenance costs, property taxes, condo fees, etc. By extension, the interest cost on any money that is borrowed to pay for these expenses is also a tax deduction. Smart real estate investors accomplish this by using the rental income from their portfolio to pay down their primary residence mortgage and then borrow the money to fund their rental expenses.

This process is known as debt conversion and will generate increased tax refunds over time. By using these tax refunds to pay off their mortgage faster, thereby reducing long-term interest costs.

There are many accelerators available if you’re a sole proprietor, speak with a mortgage professional or accountant to learn more.

This system lets homeowners knock years off the life of a non-deductible mortgage and simultaneously build an impressive financial portfolio.

It is the most efficient way for families to raise the resources they need to secure their house and income in retirement. The Smith Manoeuvre uses the legal tools of the CRA and Canadian Financial Institutions.