GDS/TDS Ratios Explained

When qualifying for a mortgage, lenders look at your debt service ratios. This tells lenders exactly how much you can afford to borrow for a new home purchase. It is a good idea to understand how lenders calculate the maximum amount you can qualify for. The two calculations lenders do is gross debt service ratio (GDS) and total debt service ratio (TDS)

Debt Servicing is the measure of your ability to meet all your financial obligations. This shows whether you can service a mortgage.

The first is called “the gross debt service ratio (GDS). This is a percentage of your monthly household income that covers your housing costs. The second is “the total debt service ratio or TDS. This is a percentage of your monthly household income that includes your housing costs as well as all your other debts.

Gross Debt Service Ratio (GDS)

GDS is your income compared to the costs of financing a mortgage, including the proposed mortgage payment. This is the principal, interest as well as property taxes, heat plus a percentage of condo fees (if applicable)

Gross Debt Service Ratio

(Monthly mortgage payments + Property taxes + heat + 50% of condo fees/Gross Annual Income = Ratio (should be 32%). If you have impeccable credit and solid reliable employment then lenders can exceed this ratio to 39%.

Total debt Service Ratio (TDS)

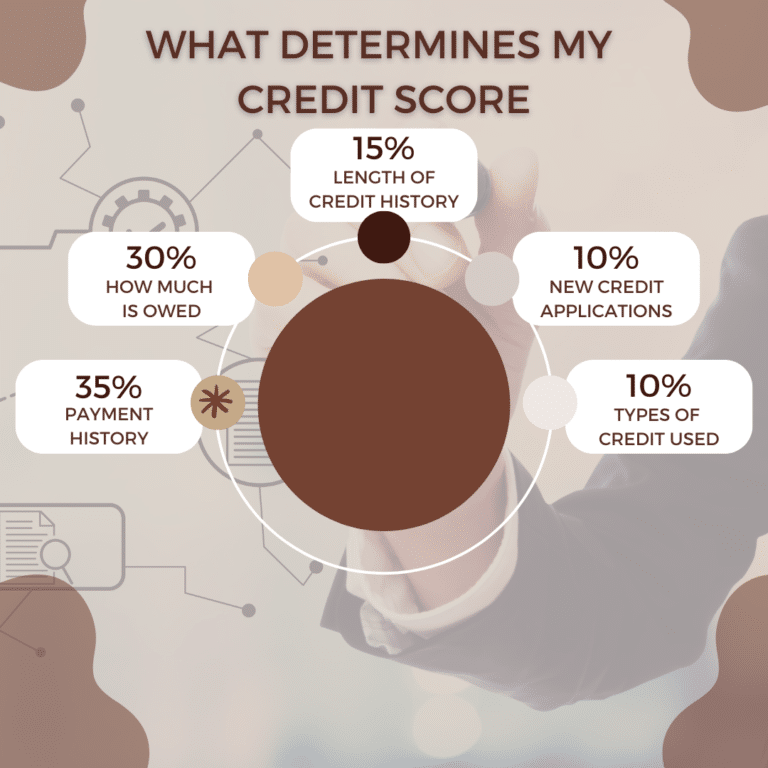

TDS is the percentage of your monthly household income that covers your housing costs and any other debts. It must not exceed 44%. Debts can include car loans, lines of credit, credit card payments, support payments, student loans, and anywhere else you’re contractually obligated to make payments.

If you do not have any other outstanding debts, then your GDS and TDS ratios will be the same. Here is how this looks:

(Housing expenses (per GDS) + Credit card payments + Car payments + Loan expenses over your income.

Want to know how much you can afford? Input your monthly income and expenses to determine what you can afford to buy. Use Calculator

So how does this play out in real life? Let’s say you’re looking to purchase a property with a $1700/month (PITH) and your total household income is $90,000 ($7500/month). This calculation would be $1700 divided by $7500, which equals 0.227 thus giving you a gross debt service ratio of 22.7%

When calculating the payment, the Government of Canada has instituted a Stress Test that requires qualifying at a higher rate and not the contract rate. Typically, the Stress test was 5.25%, however, is now the contract rate plus 2%. If the interest rate on a mortgage is 5.19% then you qualify at 7.19%

Let’s continue with the scenario. Let’s say in addition to your GDS, you have the following in other payments. You have an auto loan at $300/month, child support payment of $500/month, and between your credit cards and line of credit you have another $700/month. In total you pay $1500/month for all your other obligations. This puts you in total for all your monthly obligations at $3200/month divided by $7500/month of income equals 0.427, giving you a total debt service ratio of 42.7%

If your other debts were more, then you may not qualify. We can often look at restructuring your other debt by shuffling things around or rewriting auto loans to help you meet the debt servicing guidelines.

It can be as easy as shuffling around some of your debt to lower the payments or increase your down payment to 10%. Sometimes we can also look at taking out a cashback mortgage and using the funds to pay off other debt to eliminate the payment therefore bringing your ratios in line to qualify.

Here is the thing, as your financial situation is most likely different from the example above, working with an indepe3ndent mortgage professional is the best way to give yourself options. You may secure a handful of mortgages over your lifetime; we do this every day with people just like you.

It is never too early to start a conversation with a qualified mortgage professional. We will go over your application, assess your debt service ratios and offer suggestions to give you time to get everything in line. We want to put you in the best financial position possible.